Housing Marketing Updates

(Source / US Chamber of Commerce)

Home Prices Decline for Sixth Straight Month

March 3, 2023

Home prices have declined for six straight months every month from July 2022 through December 2022. In December they declined by 0.8% from November, the largest monthly decline since September.

Why it matters: Home prices are cooling because of higher interest rates. The average 30-year fixed-rate mortgage is now well over 6%. Up from over 3% at the start of 2022.

- The Fed has been raising interest rates since March of 2022 to bring down high inflation.

- The housing market is a major component of the economy and prices skyrocketed during COVID. Getting them down is a key part of taming inflation.

Be smart: Housing prices can still fall more before the drop becomes concerning. They are up almost 6% on an annual basis and had been up as much as 21% last summer.

- More recent data shows the housing market may be improving. New home sales, pending sales, and permits all rose in January. Home builder optimism jumped up 20%.

Looking ahead: The built-up demand for housing and a lack of supply likely means that housing prices won’t fall (on an annual basis), which is good news for homeowners. The ease in price increases continues to be good news for buyers.

Durable Goods Orders Down, but Businesses Continue Investing

March 1, 2023

Why it matters: Normally, a steep drop like that would be troubling. However, looking into the report more closely shows that volatile components account for the swings, and businesses continue to invest in capital.

Details: In December, orders for new airplanes surged. In January, those orders fell back. Airplanes are expensive, of course, so changes in orders cause big swings in the data.

- But: Core capital goods spending, all durable orders minus volatile aircraft and defense spending, was up a solid 0.8%, which was above inflation for the month.

Be smart: This tells us that despite all the bumpiness in the economy, and while businesses continue to tell surveys they see an upcoming slowdown, they are forging ahead with all-important capital investment.

Bottom line: The economy is in better shape than most anticipated it would be. This means, if the slowdown everyone expects is to come this year, it may come later in the year rather than mid-year as most predicted.

Q4 GDP Revised Down Slightly

February 24, 2023

The economy grew 2.7% in the fourth quarter of 2022. Originally, the estimate was 2.9%. GDP numbers are revised twice, so we’ll get one more estimate for how the economy grew to close out last year.

Why it matters: While the economy is holding up well so far this year, many analysts still expect a mild recession in the middle of the year.

- Yes but: The recent strength of consumer spending and the labor market has made projections more optimistic, either for a less-severe recession, or none at all.

Details: The minimal adjustment was because of spending wasn’t as high as originally estimated and imports were greater. Business investment, however, was stronger than previously thought.

- The revisions did not change the annual growth rate for 2022, which remains at 2.1%.

Be smart: According to the Chamber’s analysis, growth in Q1 2023 is tracking slightly positively. The Atlanta Fed’s real-time tracker has the economy growing significantly more – 2.5% this quarter.

- We’re only a bit more than halfway through the quarter though, so these estimates could change or converge.

What’s Happening with Interest Rates?

February 22, 2023

The Federal Reserve raised its key interest rate again earlier this month. That was the eighth time it has done so in the last year, and a few more small hikes are likely coming with inflation still high and consumer spending and the job market still hot.

Why it matters: The Fed’s actions have translated into higher interest rates for consumers and businesses, but the increases in rates have tailed off.

- For example, the average rate on a 30-year fixed mortgage peaked at over 7% in November. It has since stabilized at around 6.3%.

- On the business side, the average rate for a AAA-rated corporate bond peaked at around 5.4% in October and has since settled at around 4.6%.

Big picture: The slight drop in rates from late 2022 and their stabilization since indicates that the markets originally overestimated how much the Fed would raise rates. The markets now believe the Fed won’t raise rates much more than it has.

- This is good news for the housing market because, if it holds, it means the damage of higher mortgage rates is already in the rearview mirror.

- For businesses, it means borrowing costs are likely to remain where they are. That will allow for better planning and an increase in long-term investing.

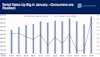

Consumers Keep Spending

February 17, 2023

Retail sales rose a remarkable 3% in January. That is after declines in November and December, which had led many to believe consumer strength was sapped.

Why it matters: Based on last month’s data, consumers still can spend despite inflation, dwindling savings, and shrinking room on their credit cards.

By the numbers: Sales were up in almost every category:

- Motor vehicles and parts dealers (5.9%)

- Furniture stores (4.4%)

- Electronics and appliance stores (3.5%)

- Building material and garden supply stores (0.3%)

- Food and beverage stores (0.1%)

- Health and personal care stores (1.9%)

- Clothing and accessory stores (2.5%)

- Sporting goods and hobby stores (0.2%)

- General merchandise stores (3.2%)

- Food and drinking places (7.2%)

- Sales were unchanged at gas stations (0%)

Bottom line: Consumer strength has buoyed the economy since Covid. As long as the job market remains robust and incomes steady, consumers will have money to spend, even if they are falling slightly behind inflation. This could put a floor beneath spending and keep it stronger than in previous economic slowdowns.

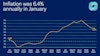

January Inflation rose 0.5%. Up 6.4% Annually.

February 15, 2023

Inflation’s surprising resilience in January shows we aren’t out of the woods, despite some progress in recent months.

Related

- It rose 0.5%, and when compared to a year ago, prices increased 6.4%.

- The rise from December to January was the biggest monthly gain since October.

Why it matters: The jump in inflation broke a 2-month trend of lower monthly inflation, but annual inflation cooled more in January.

- Core prices, excluding more volatile food and energy prices, rose 0.4% from December. Core inflation is up 5.6% annually, which is still high.

By the numbers: Price increases for necessities are still putting enormous pressure on family budgets:

- Housing costs were up 0.7% from December to January and are up 7.9% annually. (The biggest driver of the monthly increase.)

- Gas prices rose 2.4% from December and are back up 1.5% from a year ago.

- Electricity was up 0.5% on the month and is up 11.9% annually.

- Grocery prices were up 0.4% from December and 11.3% annually.

- New car prices were up 0.2% from December and are up 5.8% annually.

- Used car prices fell 1.9% and are down 11.6% annually.

Bottom line: The previous monthly declines raised hopes for an end to interest rate hikes, but the stubbornness of inflation likely means the Fed will keep raising rates to bring prices down.

Credit Card Debt Growth Slowed in December

February 10, 2023

Total credit card debt rose 0.6% in December.

- That is the lowest monthly increase since July 2021.

- It had risen 1.3% in November and 1.1% in October.

Why it matters: The downturn in growth is both surprising and expected.

- It is surprising because it is a sharp drop from recent months. Many assumed consumers would keep adding to their credit balances at a high rate as inflation makes it difficult for families to make ends meet.

- At the same time, it was expected consumers would start using their credit cards less because their total spending is declining as inflation remains high, credit balances rise, and savings run out.

Big picture: Total credit card debt is still only 9% higher than in February 2020. Over that time, incomes have risen by almost 16%. Consumers still have some credit capacity.

- But it is likely that consumers with lower credit ratings have used more of their borrowing ability than those with higher credit scores. These consumers may have run out of room on their cards and therefore have had to stop using them until they pay down their balances.

Bottom line: Credit balances were going to stop growing at a rapid pace at some point. That they decelerated in December was earlier than most anticipated, but it is in line with other data showing consumers are slowing down their spending as we enter 2023.

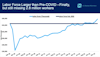

Surprise January Jobs Surge

February 8, 2023

The economy added 517,000 jobs in January. No one saw this coming. Consensus expectations were for 185,000. We blew those out of the water.

Why it matters: The labor force also grew by 866,000 workers. We now have more workers in the labor force than pre-COVID but not nearly as many as we should have based on population growth.

Details:

- Leisure and Hospitality added 128,000; Education and Health 105,000; Professional and Business Services 82,000; Government 74,000; Wholesale and Retail Trade 41,400; Construction 25,000; and Transportation and Warehousing 23,000.

- Utilities (700) and Information (5,000) were the only industries to lose jobs.

And: Wage gains were strong again, rising 0.3% from December and 4.4% annually from January 2022.

But: The bad news remains the participation rate (the percentage of workers in the labor force as a share of the working-age population). It remains well below its pre-COVID level.

- If we had the same participation rate now as in February 2020, there would be 2.8 million more workers in the labor force.

Bottom line: Businesses still have 11 million openings to fill, so we need workers to keep coming back.

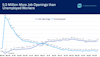

Job Openings Defy Expectations in December

February 3, 2023

Job openings rose by 572,000 at the end of December from November to more than 11 million in total.

Why it matters: There are now a whopping 5.3 million more job openings than unemployed workers. The cooling economy should cause businesses to cut back on their job postings – at least one would expect. But that is not the case so far.

By the numbers:

- Postings were up in accommodation and food services (409,000), retail trade (134,000), and construction (82,000).

- They decreased in information (107,000).

Be smart: The labor market remains tight. Hiring and quits remained at roughly the same level as in November. So businesses are still adding workers, and workers are still confident they can quit their current jobs and find better ones easily.

- The quits rate was 2.7% in December. That is below the all-time high rate of 3%.

- 4.1 million people quit their jobs in December, down from the 4.45 million all-time high in March, but still historically high.

- Quits decreased in transportation, warehousing, and utilities (-69,000), but increased in other services (+65,000)

Bottom line: The stubbornness of job openings reminds us that we remain in a unique labor market. Usually, jobs do not remain plentiful when the economy is softening.

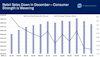

Consumer Spending Slows

February 1, 2023

Consumer spending declined in November and December. Consumers’ ability in the last 18 months to keep spending above inflation was impressive. It seems that ability is finally waning.

Why it matters: We’ve at last hit the inflection point where accumulated savings and credit card balances can no longer help consumers keep spending above inflation.

- This is likely to carry over into 2023, which means the beginning part of the year is unlikely to keep pace with the strong 2.9% growth in the fourth quarter of 2022.

By the numbers:

- Consumption fell 0.2% in December.

- Accounting for inflation, real spending was down 0.3% because inflation was 0.1%.

- Inflation-adjusted spending on goods was down 0.9% (durables 1.6% and nondurables 0.4%).

- Inflation-adjusted spending on services was unchanged.

But: The silver lining to the recent data is that income, including salaries and wages, continues to grow strongly. It rose another 0.3% in December.

- That will put a floor on the drop in spending even if it doesn’t prevent a decline.

Bottom line: Inflation-adjusted spending won’t grow again until inflation falls more, especially for necessities like food, energy, and housing, which is putting the most strain on families’ budgets.

Read more from the Chamber:

- Economic Data: Comprehensive quantitative snapshots of business sectors and topics to help business and political leaders make informed decisions.

- Workforce Data:Capturing the current state of the U.S. workforce.

- Small Business Index: The MetLife & U.S. Chamber of Commerce Small Business Index is released on a quarterly basis and is compiled from 750 unique online interviews with small business owners and operators each quarter. The Index delivers a comprehensive quantitative snapshot of the small business sector as well as explores small business owners’ perspectives on the latest economic and business trends.

- Middle Market Business Index:The survey panel consists of approximately 1,500 middle market executives and is designed to accurately reflect conditions in the middle market.