A different way to plan your retirement

Justin Peek

PEEK Wealth

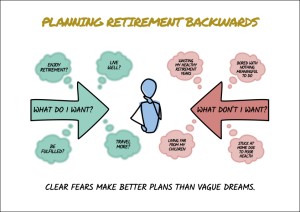

Most people plan their retirement by looking forward, trying to envision their perfect future. “What do I want to do? Where do you want to live?” Unfortunately, most people have no idea what they want.

Ask someone to describe their ideal retirement and you’ll get vague answers. “Travel more.” “Spend time with family.” These sound nice, but they’re not specific enough for planning.

Here’s a different approach that gets you better answers much faster: start with what you don’t want. This comes from Charlie Munger, who made “invert, always invert” one of his core principles. Instead of asking “How do I succeed?” consider asking “How do I fail?” and then work to avoid those outcomes.

When you ask, “What would make my retirement miserable?” the answers come quickly. These fears are specific and actionable. Avoiding them brings you remarkably close to the life you want.

The Overlooked Mistakes to Avoid

The financial regrets of retirement get all the attention. Not saving enough, retiring too early, and underestimating costs are common financial pitfalls. Most advisers typically cover these areas well.

We believe four lifestyle mistakes can ruin your retirement, even if your money is sorted.

Missing your active window.

Most people have roughly 15 years of healthy, mobile retirement before things get harder. Yet many waste these precious years because they didn’t plan for travel and adventure while they could still enjoy them.

Losing your identity and purpose.

After 40 years of career structure, many retirees feel completely lost. They have money, but it lacks a sense of usefulness or meaning. The days feel empty because work provided more than just income.

Relationship isolation.

Some retirees find themselves living far from adult children and grandchildren, or they’ve let friendships fade during busy career years. Money can’t buy back lost time with people you love.

Neglecting health in your 50s and 60s.

This is when prevention matters most. Poor health choices during these years can significantly reduce the quality of your entire retirement, regardless of how much money you have saved.

All of these issues can be avoided entirely through proper planning.

How to Apply Inversion Thinking to Your Retirement Planning

Instead of looking back after mistakes, a “pre-mortem” asks you to imagine failure before it happens. Picture yourself at 80, filled with regret. Ask: What went wrong? What do I wish I’d done differently? Write down your first thoughts, then get specific—Where did I want to travel? Which health habits mattered most?

From there, work backward. For each regret, identify what you can start doing now. If you fear losing touch with family, think about where you’ll live. If you worry about purpose, develop interests beyond work. This quick exercise can bring clarity today—and save you decades of regret.

Your Next Step

Most retirement advice focuses on the numbers—how much to save, when to retire, how to invest. These are important, but they’re not enough. Fulfillment requires thinking beyond the spreadsheet—imagining not just the money you’ll have, but the life you’ll live with it.

Inversion thinking offers a way to do this. The pre-mortem isn’t one-time; your priorities will shift as you age. What matters at 50 may look different at 60, so regular check-ins keep your plan aligned.

If you’d like help applying this approach to your life and financial planning, PEEK Wealth is here to guide you.